Lemonade, a U.S. based insurtech company, has recently filed their S-1. I’ve been following this company closely for some time, and was always curious on a few topics on a deeper level, especially profitability, growth, and strategy.

A quick biz overview, Lemonade provides renters and homeowners insurance for most of the United States. They are a full-stack insurer, meaning they underwrite policies and process claims. Their main value propositions are a snappy product for a pleasant insurance buying experience, use of AI and machine learning to lower costs, and a giveback program which donates excess premiums to a charity of the policyholder’s choice. They positioning themselves as an anti-insurer, and are outwardly focused on making insurance fun again.

Post review of their S-1, a few alarm bells are ringing for me, especially as it relates to 1) unit economics and 2) future revenue growth. Lemonade still has to price their IPO, but this can be a potential (expensive) near-term short opportunity post public trading.

Unit Economics

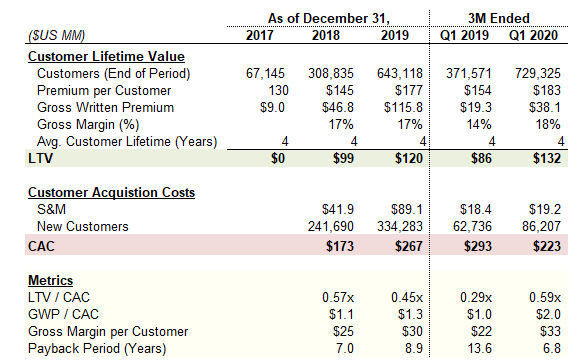

Lemonade’s unit economics appear challenged, let’s take a deeper look using a LTV (Lifetime Customer Value) / CAC (Customer Acquisition Costs) framework.

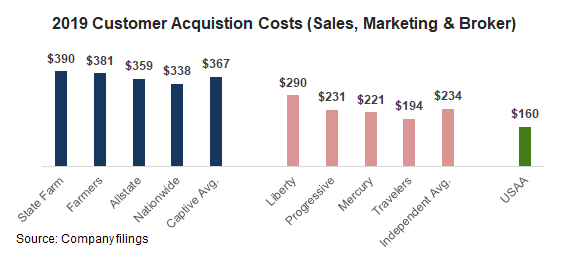

Customer acquisition costs for the homeowners insurance industry in the U.S. are incredibly high compared to other major industries. Captive agent insurers (agents who only work for one insurance company) possess the most expensive CAC, followed by the independents and then direct to consumer. Homeowners insurance costs ~$50 per click(!), as a reference point.

Let’s compare this with Lemonade.

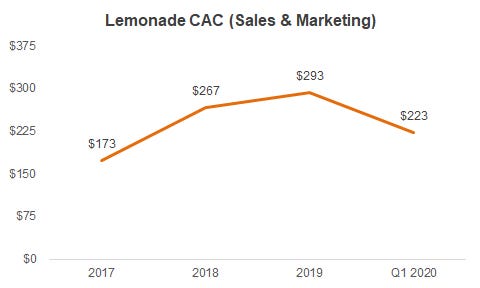

It appears Lemonade’s CAC is in-line with the independents, which is troubling for a number of reasons. Let’s use my calculations below, to frame the rest of the discussion. The figures are based on the latest (June) S-1.

A typical homeowners policy premium per year is ~$800 - $1,000. Compare this dollar amount with Lemonade’s much lower premium per policy.

Lemonade’s revenue is heavily weighted toward the Renters end market. Per their recent S-1, Renters generate approximately $150 per year of premiums and Homeowners contribute around $900 per year. Lemonade’s average premium per customer in Q1 2020 was $183 per year, and $177 in 2019. For a traditional SaaS business, year 1 revenue should cover the cost to acquire that customer. Even more concerning is Lemonade’s gross margin is sub-20%, which leads into my second point.

Lemonade would require a very high gross margin coupled with long customer lifetime in order to achieve the coverage stated below:

Since March 31, 2019, our marketing efficiency roughly doubled, such that we are currently able to acquire more than $2 of in force premium for each $1 of marketing investment. Given our predictable gross margins, strong retention rates and the propensity of our customers to spend materially more with us over time, we believe that the lifetime value of our customers is significantly higher than our cost of acquiring them. Applying a roughly 20% gross margin, we would earn back the cost of acquiring our customers in just over two years. Any annual coverage increases, graduation of renters to homeowners or new product introductions, pet insurance for example, further shorten the payback period and drive up lifetime value.

The S-1 is slightly misleading. The mechanical calculation is correct (see my Gross Written Premium / Cost to Acquire calculation). Lemonade is stating they spend $1 to generate $2 of Gross Written Premium (GWP, think similar to bookings in a SaaS company). Sounds great? Think again.

The gross written premium is a top line, revenue-like figure. After you remove the cost Lemonade needs to pay out in claims, they are left with $33 of gross margin per customer (18% gross margin * premium per customer). This would imply a payback period of nearly 7 years on a CAC of $233.

LTV / CAC calculations typically aren’t spelled out in an S-1 for many reasons, but I am very curious of Lemonade’s assumptions behind earning back the cost in 2 years, especially when they state retention rates are ~75%, which would imply an average customer lifetime period of 4 years (used in my calculation).

Future Revenue Growth

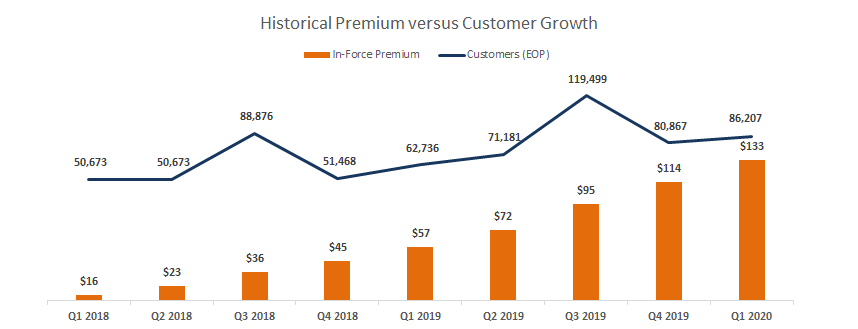

At first glance, Lemonade’s revenue growth appears robust. High quarter over quarter growth, driven by ~85K of net customer adds in the most recent quarter despite COVID-19.

The S-1 uses in-force premium as a proxy for growth. Think of this metric like run-rate revenue for all current customers, at the end of a period. I think this is an appropriate metric to infer growth, and better than net earned premium (another word for GAAP revenue for insurance), which doesn’t tell the whole story due to revenue recognition rules.

What I’m most concerned with is the following:

Beginning on July 1, 2020, we will have proportional reinsurance protecting 75% of our business (the "Proportional Reinsurance Contracts"). Under the Proportional Reinsurance Contracts, which spans all of our products and geographies, we transfer, or "cede," 75% of our premiums to our reinsurers. In exchange, these reinsurers pay us a "ceding commission" of 25% for every dollar ceded, in addition to funding all of the corresponding claims, i.e. 75% of all our claims. This arrangement mirrors our fixed fee, and hence shields our gross margin, from the volatility of claims, while boosting our capital efficiency dramatically.

Very interesting, now the growth story shifts and I believe this calls into question Lemonade’s true value proposition.

I appreciate the costs to be a full stack insurer. Capital requirements are both onerous and incredibly expensive, but that’s what Softbank’s for, right? To me, this seems like a move that contradicts their utilizing of ML and AI (mentioned multiple times in the S-1) to become more efficient versus than competitors and ultimately lower loss ratios. Lemonade may still be in the data-gathering stage to inform correlations for their algorithms, but if Lemonade believes they can truly more efficiently price risk and identify high-risk policyholders, I wouldn’t think cedeing or handing over the majority of their premiums to reinsurers would be the correct strategy, as Lemonade should, in theory, participate in the upside from their technology platform.

Lemonade states this is a capital efficiency decision, but I think it’s coming from a capital preservation position. The spend on acquiring customers is high, and to be essentially become a short-term broker and be paid a 25% commission for the steep CAC is a step in the wrong direction. I will caveat this with terms of the reinsurer deal may be favorable for Lemonade, and there might be a sliding scale for lower loss ratios = higher commissions paid back to Lemonade. Still, this then means they need years to collect the data they need to execute on their big data strategy.

Lastly, Lemonade will likely be currently priced and future(ly) valued on revenue growth. Thus the strategy of lowering their revenue, as ceded revenue to reinsurers doesn’t contribute to GAAP revenue, doesn’t make too much sense to me given net income breakeven isn’t even close to being on the horizon ($100M loss last year, and run rate ~$150M loss this year).

Conclusion

Lemonade has a great product. I personally enjoy using their app - its smooth, incredibly user friendly, and turns a chore into a pleasant task. Lemonade’s revenue growth has been incredible thus far. Despite the tear-down above, I think there is strong product market fit and the target market appreciates the value proposition. Unfortunately, at this stage of a company’s life and the current environment, public investors will not view widening losses in a positive light.