🚴♀️An Uber Move🚴♀️

Commentary on Uber's acquisition of Postmates

Quick Note: Lemonade is currently trading at $81 / share, implying a $4B valuation, and a 28x revenue multiple. For context, this is where Tier 1 SaaS (Zoom, Datadog, Coupa, etc.) has historically traded. Tier 1 encapsulates massive growth, positive cash flow, and innovation leadership in a growing TAM. Seems iffy this would apply to Lemonade, we’ll check back in a few quarters.

To nobody’s surprise, Uber announced its $2.65B acquisition of Postmates yesterday. At first glance, the deal is value creating for Uber. After Grubhub slipped through the M&A cracks, Postmates is the next best option at a reasonable price. With all acquisition announcements, it’s challenging to pierce the veil of corporate speak, so I put a few thoughts together and enlisted industry contacts to help validate perspectives on the underlying highlights and considerations, and overall strategic rationale.

Valuation & Structure Thoughts

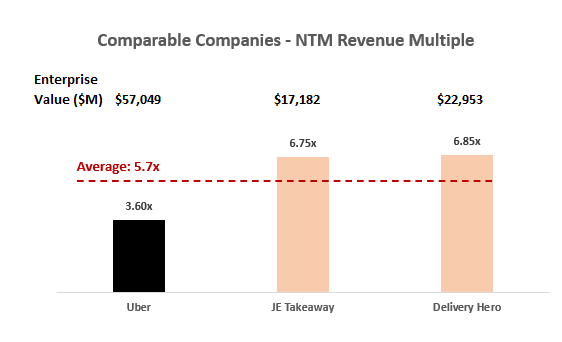

Postmates exchanged hands at a market multiple that appears in-line with recent U.S. food delivery transactions. Grubhub was purchased for a similar multiple last month, Caviar is sub-scale, and DoorDash’s multiple is based on their June 2020 capital raise, therefore not including a premium, but I have included based on transaction recency, relevance and their #1 player status.

On a public companies basis, Uber trades at a much lower consolidated multiple and the other competitors are leaders in their international markets, rationalizing the premium.

From a purely financial perspective, since Uber possesses a negative EPS, it doesn’t make sense to perform a traditional EPS dilution analysis, however horse trading ~5% Uber ownership for the last, remaining competitor at scale with ~8% market share, strategically makes sense to me. There probably is an analysis we can do with calculating the cost to raise equity and comparing it to the value Postmates generates, but we won’t go there today (super theoretical and would be making up numbers past 2021).

From a structuring perspective, Uber selected the optimal time to issue stock as it has rebounded to January 2020 levels. Typically, all-stock deals are expensive for the buyer (EPS dilution) and the seller requires higher consideration when comparing to another cash/stock offer. However, in this case 1) cash preservation is a priority for Uber, 2) the cost of issuing new debt is expensive @ ~7.0% yield-to-worst, and 3) the SPAC partner represents a nebulous future.

Key Highlights

Most of the merits have been well covered by the Street. If I distill the strategic advantages of the deal into three realizable points and look past the marketing, the key upsides are:

Market Share - Capturing & becoming the clear #2 player, owning the #1/2 position in 8 out of 12 key metro markets, and the #1 position in the Los Angeles market (industry standard data per SecondMeasure)

Financial Metrics - Booking growth (67% y-o-y), take rate accretion (+6% higher), and leveraging Postmates’s path to profitability (2H ’20)

Delivery-as-a-Service – Delivery of B2C goods and groceries is a rapidly growing market with adoption accelerated by COVID. DoorDash is generating inroads with similar services (CVS) and realizes this is an attractive space.

The Considerations Uber Doesn’t Tell You…

…or maybe its simply not on Uber’s radar. Whichever it is, I believe Postmates does not fix Uber’s core issues that drove the significant loss of market position in 2019.

This chart is a bit noisy (thanks equity research), but if you compare Uber’s 2019 starting and ending position with DoorDash’s position, its clear Uber’s market share quickly began eroding in Q4 ’18 and the deterioration accelerated through 2019. The key attributes that lead to the deceleration have not been fully addressed, and the Postmates deal merely band-aids the situation while DoorDash continues to compound on its core advantages.

King of the Suburbs - Densely populated cities appear to be attractive markets for food delivery, however urban delivery margins are meaningfully lower compared to the suburban markets which Doordash historically has focused on and dominates today. From a revenue perspective, suburban order check sizes are on average ~30% higher, driven by families vs. single person orders. Additionally, the fee DoorDash earns is variable, thus a larger check size equates to higher revenue for DoorDash. On the cost side, the delivery fee is a fixed cost and not a variable cost, so a $150 order costs roughly the same to deliver as a $50 order. Operating leverage! We combine these few inputs to arrive at a higher overall margin, and quickly begin to see how powerful the suburban story becomes and this gives credence to DoorDash’s rumored Q2 ’20 cash flow breakeven target.

Despite its metro focus, Postmates possesses higher than average check sizes driven by their premium restaurant partners. This is great, however Postmates’ operating scale limits them to a few select markets while DoorDash continues to penetrate into key suburbs e.g. Northeast and Florida. You may be wondering why not copy DoorDash’s playbook? This brings me to my next topic.

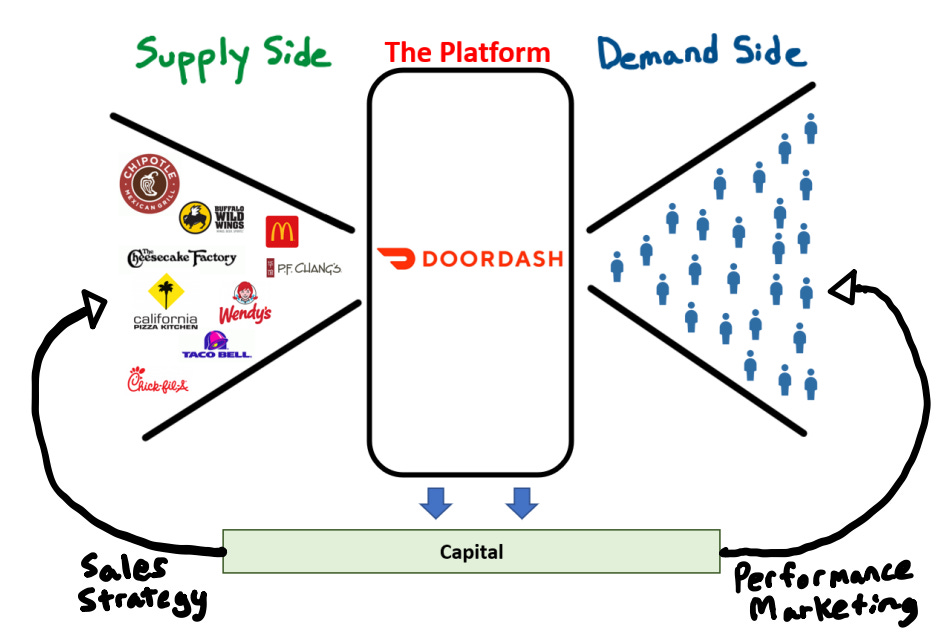

Two Sided Marketplace Dominance – A buzzy Silicon Valley term (unfortunately often mis-used at my probably-not-a-unicorn-anymore company) which applies to DoorDash’s strategy. DoorDash has invested heavily on building its two-sided marketplace the right way. On the supply side, their Sales teams operate extremely efficiently, structuring deals and on-boarding restaurants. Of course there are a few snafus, highlighted by the infamous pizza arbitrage story, but hey, that’s the price of growth right? On the demand side, DoorDash has focused on performance marketing vs. Uber’s brand advertising push. DoorDash also is aggressive but not reckless with their promotions. They have optimized their algorithm to learn from past data, including time-of-day, repeat user behavior, and pricing trends to build diner volume. Uber & Postmates still very much employ a shotgun approach.

My amateur attempt at a Ben Thompson diagram, illustrating the two-sided flywheel below.

As the flywheel begins to spin and generate cash, we expect DoorDash to reinvest the proceeds back into the business and execute its playbook deeper into Tier 1 and eventually Tier 2 markets. Their flywheel represents an operational moat that deepens and continues to evolve as DoorDash learns from each market. Postmates’s operations aren’t in the same class (if they were, the cost synergies wouldn’t be $200M), and Uber fumbled badly in 2019 with sub-optimal Sales and Marketing strategies and the gap has only widened since. The prospect of catching up to DoorDash’s ever growing moat doesn’t seem achievable with the addition of Postmates.

Limited Synergies – From a cost synergies perspective, the $200M figure directionally makes sense as redundant tech, operations, marketing and other corporate functions are consolidated. However, I believe the excitement stemming from utilization driven revenue synergies is misplaced.

Uber believes that Postmates brings superior batching and chaining technologies (e.g. its ability to deliver 3 orders per hour, most of which is food delivery) as well as technological infrastructure to facilitate operations with nonpartnered merchants. We believe integration of the Postmates' technology on the back end can potentially enhance the existing Eats infrastructure that would allow for better unit economics and utilization of couriers that would assist in accelerating the path to profitability for Uber's business.

Deutsche Bank - Uber Follows 4th of July Fireworks with an Acquisition – July 6, 2020

The Street believes Uber can leverage key operational leanings or utilize a piece of machine learning technology for batching the couriers to drive utilization broadly across all markets. Unfortunately, the solution isn’t as attractive as it appears on paper.

Postmates is the number one player in the LA market, and their courier utilization is thus maximized in this particular market, driven by 1) owning demand so supply gravitates towards the platform, 2) differentiated supply with locked-in quality restaurants driving diner demand, and 3) couriers are paid less per trip, offset by the higher number of trips. While its 100% correct that Postmates operates at a 3 trip / hour efficiency in LA, the same is true of Uber & DoorDash in the markets in which they hold similar positions. The secret sauce is in scale and massing the couriers to optimize routing, and not a hidden playbook (Annexation of Puerto Rico, anyone?). Efficient batching technology has already been solved by every large player.

The topic of scale brings me to my last point. This is an acquisition driven by competitor scarcity in a bigger-is-best market, where the largest players aggregate both sides of the supply & demand equation and achieve better utilization. The US is littered with shuttered, sub-scaled startups in the food delivery space who couldn’t make the economics palatable. Uber’s decision to purchase Postmates is the right deal at the right time, however they need to continue looking inwards to fix major operational issues to take market share from DoorDash and not continue to fall behind.